by someone who is dyslexic, has ADD… and still managed to find ROI in the chaos.

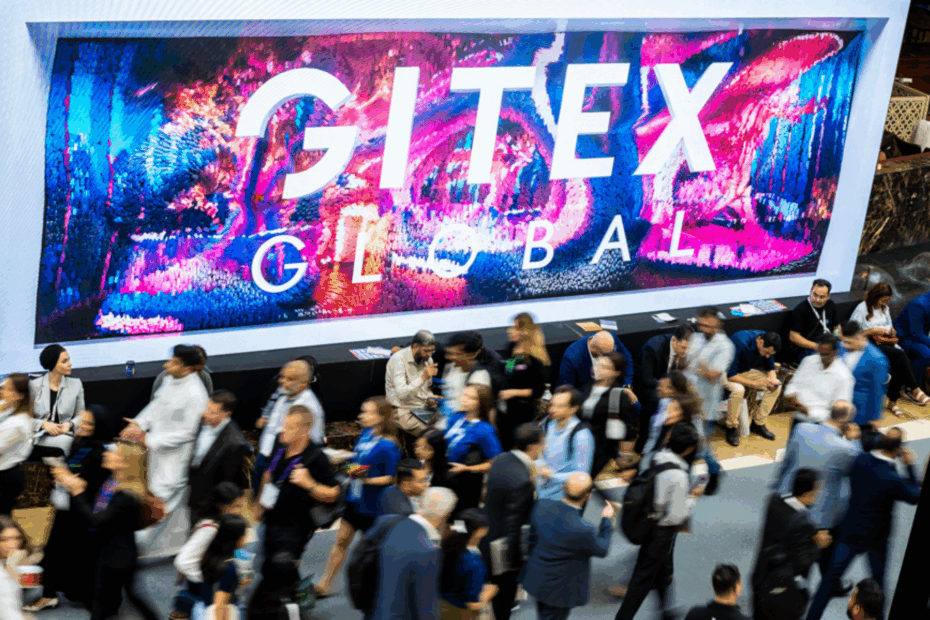

GITEX is not a conference, it’s an ecosystem, a marketplace, and, frankly, a test of human attention span. With over 200,000 people, thousands of exhibitors, and enough LED lights to power a small country, it’s easy to walk in excited and leave overwhelmed.

As an investor, executive, or decision-maker, you don’t just want to attend – you want to extract value. Here are six ways to do exactly that (sprinkled with the occasional ADD-friendly observation to keep us awake).

1. Anchor Yourself in an Investment Thesis

Walking into GITEX without focus is like opening Netflix without a plan: you’ll end up three hours later watching a documentary about competitive balloon twisting.

Investors should arrive with a clear thesis:

- Am I here for AI applications in retail?

- Am I scouting sustainable tech?

- Am I meeting founders with scalable SaaS models?

This thesis will act as your compass. My ADD brain, of course, still got distracted by a booth selling robot dogs. Worth it.

2. Prioritise Relationships Over Demos

Booths are impressive, but people close deals, not robots on screens. The most valuable conversations often happen outside the exhibition floor, at coffee lines, private dinners, or even while waiting for a ride.

Tip: Schedule fewer product demos, more one-on-one conversations. That’s where trust – and eventual investment returns – are built.

3. Look for Signals, Not Noise

Every year, GITEX is full of buzzwords: blockchain, metaverse, quantum, generative AI. The trick is to look for signals of adoption and scalability:

- Which companies have early revenue?

- Which pilots have converted into real contracts?

- Who’s solving problems vs. chasing trends?

ADD moment: I once followed a flashing neon sign that said “AI Future.” It turned out to be a VR karaoke booth. The metaphor writes itself.

4. Build in Reflection Time

Investors often make the mistake of filling their schedule wall-to-wall. The result? Decision fatigue.

Instead, block one hour each day to step back, review conversations, and reframe insights into portfolio context. Ask yourself:

- Does this align with my fund’s strategy?

- Is the founder solving a “painkiller” or just building a “vitamin”?

- Where’s the exit pathway?

(Also, give your brain a break. I recommend strong karak tea. Works better than venture capital sometimes.)

5. Guard Your Health Like It’s Part of the Deal

Here’s something most people forget: GITEX is a marathon, not a sprint. Your ability to spot good deals depends on how sharp – and awake – you are.

- Hydrate: Drink more water than you think you need. (Yes, coffee counts, but your kidneys disagree.)

- Eat well: Don’t just survive on free booth candy. A balanced meal will keep your brain firing.

- Fresh air: Step outside once in a while. A five-minute walk in daylight does more for focus than another demo.

- Immunity check: Crowds are intense. Rest well, wash your hands, and maybe sneak in that vitamin C.

ADD confession: I once left GITEX so drained I ordered shawarma and forgot I’d already ordered shawarma. Double dinner, but zero clarity. Don’t repeat my mistake.

6. Embrace the Serendipity

The paradox of GITEX: you must be structured and open. Some of the most transformative connections come from unplanned encounters. An off-schedule chat with a founder in an overlooked corner could be your next unicorn.

ADD humor aside – investors know this: serendipity is often disguised as distraction.

Final Word

For serious investors, GITEX is less about technology itself and more about the translation of innovation into business value. The companies worth watching aren’t the loudest; they’re the ones scaling quietly, with strong teams and real contracts.

So: go in with focus, guard your health, ask sharp questions, and allow yourself the occasional distraction, because sometimes chasing the wrong shiny object leads you straight to the right opportunity.